The EU-Mercosur trade agreement is approaching a critical juncture, with the European Commission aiming to finalise it during the South American trading bloc's December 2024 summit in Uruguay. The deal has gained significant political momentum. Commission President Ursula von der Leyen backs it, as well as 11 EU member states, including Germany and Spain. Nonetheless, challenges remain, and its path forward is far from certain.

France remains firmly opposed to the agreement. President Emmanuel Macron has voiced concerns about potential damage to France’s agricultural sector and environmental risks, particularly regarding deforestation in Brazil linked to increased beef imports. With the renewed push to finalise the agreement, French Prime Minister Michel Barnier and Europe Minister Benjamin Haddad are attempting to build a coalition of other hesitant countries to delay or reshape the terms of the pact.

The French government's opposition to the EU-Mercosur trade deal is deeply rooted in domestic political pressures. The agricultural sector, not only a powerful lobby but also an important pillar of the French economy, fears increased competition from cheaper South American livestock entering the European market. To address these concerns, the European Commission has proposed a compensation mechanism for European farmers. The French government and farming unions have deemed this mechanism insufficient, with unions already staging protests in response.

The Urgency of Critical Raw Materials

Within the EU, there is now a broad consensus that enhancing economic security requires forming partnerships with other like-minded nations, while also deploying trade measures and industrial policies to protect European businesses from unfair market practices and economic coercion. The revelation of the EU’s reliance on Russian energy, emphasised the need to boost self-sufficiency and diversify sources for key imports.

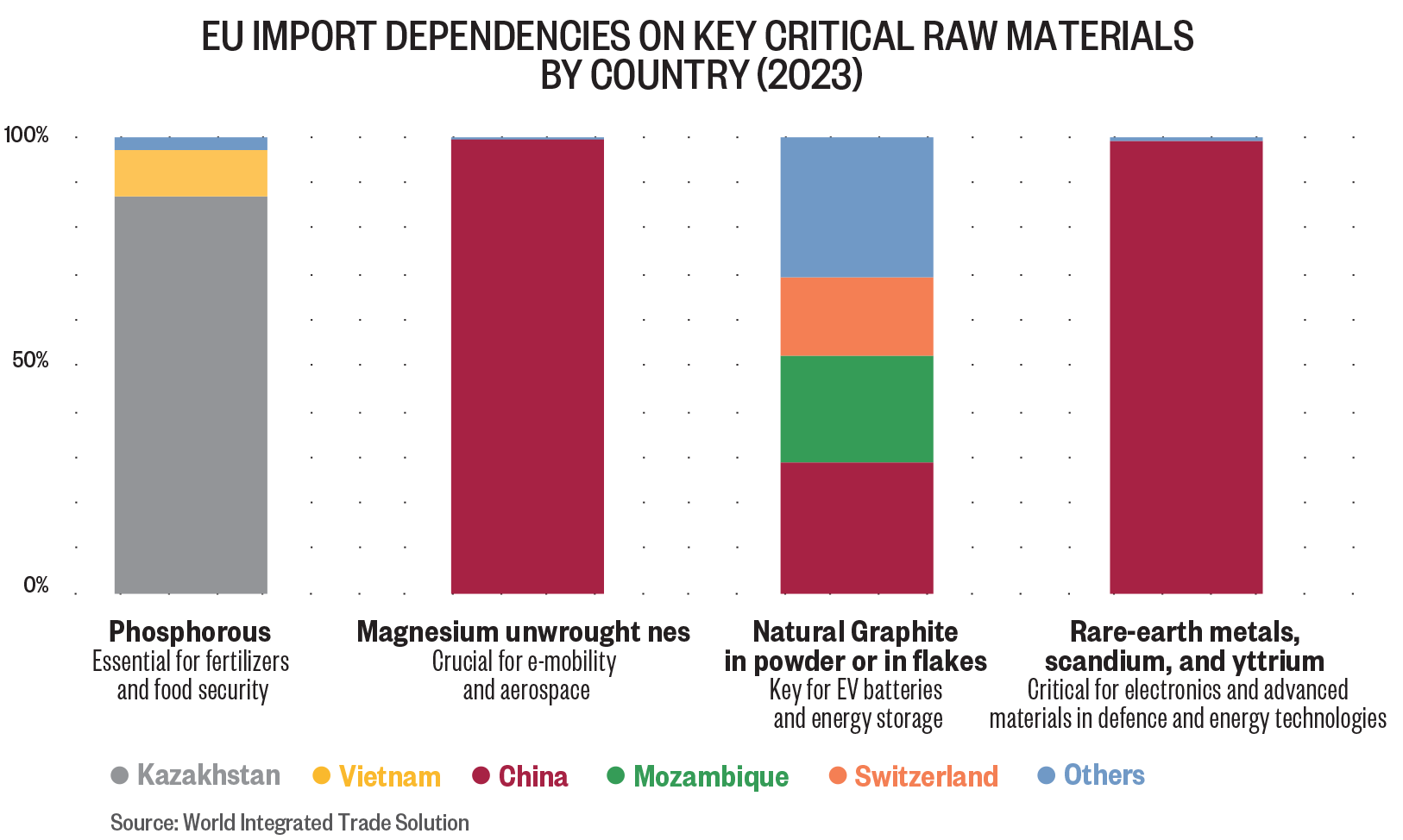

The EU remains overly reliant on certain strategic resources, particularly critical raw materials (CRMs), of which it has only minuscule global reserves. These inputs are essential for clean technology and defence equipment production. This dependence poses significant risks, particularly as China dominates the mining and refining of many CRMs. Beijing, having previously shown a willingness to weaponise trade -including against EU member states - exposes Europe to unacceptable supply chains vulnerabilities.

According to the International Energy Agency, global demand for CRMs like lithium, and cobalt is expected to rise sharply by 2040, with lithium demand projected to surge 42-fold from 2020 levels. By 2030, the EU will require 18 times more lithium and five times more cobalt to support its green energy transition.

Although some member states are exploring ways to boost domestic production of CRMs and seeking partnerships with neighbouring countries like Serbia, these initiatives face significant challenges. They are often costly, difficult to scale, and susceptible to internal politics and public resistance. For instance, French plans to expand domestic CRM production through new lithium mining projects may be delayed or deprioritised because of austerity measures. Even with increased investment, establishing mining operations and processing facilities can take over a decade, posing significant challenges for the EU to meet its immediate needs for the green transition.

In contrast, the EU-Mercosur agreement offers a more stable, efficient, and cost-effective framework. The deal’s binding provisions aim to eliminate government-imposed export restrictions and regulatory barriers, such as import and export price requirements creating opportunities to strengthen CRM price stability. However, the agreement does not fully guarantee security of supply, as market dynamics will continue to influence availability. Nonetheless, it represents a critical step toward diversifying the EU’s sources of these key materials, which are abundant in South America.

Mercosur member states Argentina and Bolivia collectively hold approximately 44 million tons of lithium, accounting for nearly 43% of global reserves. Brazil has one of the largest CRM reserves in the world, including graphite, rare earth metals and phosphate rock. Getting access to these deposits would help diversify Europe's CRM supply chains and reduce reliance on China.

At the same time, mining these resources presents significant environmental challenges. For instance, 30% of Brazil's CRMs reserves are located within the Amazon region, raising concerns about balancing the preservation of this fragile ecosystem with the expansion of mining activities. Securing Mercosur nations as reliable partners for critical minerals will require the EU to advocate for sustainable extraction practices that adhere to stringent environmental and safety standards.

Strategic Partnerships in a Fragmented Global Economy

The agreement would also strengthen Europe’s hand in South America, where Chinese and Russian firms have invested billions in infrastructure and resource extraction projects. These partnerships may grant China and Russia priority access to the continent's minerals and considerable leverage over vital infrastructure.

By making substantial investments without requiring strict standards for transparency or governance, China and Russia risk exacerbating existing corruption and weakening governance structures in the region.

Europe can help South America reduce its dependency on Chinese and Russian investments and influence. While current left-leaning governments in countries like Bolivia and Brazil may ideologically align with China and Russia on certain issues—such as scepticism towards American influence—they have also shown interest in strengthening ties with Europe. Bolivian President Luis Arce has expressed a desire to attract EU investment, reflecting this dual interest and presenting an opening for the EU to expand its partnerships in the Western Hemisphere.

The discourse around the EU-Mercosur deal has largely been one-sided, focusing on fears of a surge of South American meat overwhelming European markets. Some economists argue that these concerns may be overstated, as the agreement would primarily rebalance trade flows, with modest imports from Mercosur countries offsetting reductions from other suppliers.

However, the strong backlash from farmers reveals a deeper dissatisfaction with EU trade and agricultural policy highlighting the need for a course correction. As part of broader EU reform, Common Agricultural Policy (CAP) reform should aim not only to ensure income for farmers, but must address mounting challenges posed by volatile markets and potential disruptions caused by climate change and geopolitical events. Europe will only succeed if it can balance social acceptability with its broader geopolitical goals.

This balancing act becomes even more critical as Europe contends with a fragmented global economy characterised by growing protectionism and trade tensions, challenges likely to deepen with Donald Trump's return and his proposed 10-20% universal tariff. In parallel, with China planning to tighten export controls on critical minerals, the race to secure essential resources is intensifying, making it more urgent than ever for Europe to forge partnerships with like-minded nations.

As High Representative Kaja Kallas emphasized, rejecting the Mercosur deal risks ceding influence in a vital region to global competitors eager to fill any void left by the EU. As part of a new and more affirmative European trade and economic security stance, France should reconsider its steadfast opposition to the EU-Mercosur deal, recognising the benefits it offers in terms of diversifying Europe’s supply chains, and reinforcing the EU’s geopolitical influence - elements which align with France’s vision of strategic autonomy.

Ian Hernandez is a Programme Assistant in the Europe's Political Economy Programme at the EPC.

The support the European Policy Centre receives for its ongoing operations, or specifically for its publications, does not constitute an endorsement of their contents, which reflect the views of the authors only. Supporters and partners cannot be held responsible for any use that may be made of the information contained therein.